In the world of forex trading, two key terms that traders often come across are pips and lots. Understanding these concepts is crucial for anyone looking into forex trading, as they help determine a trade’s profit or loss.

A pip stands for “percentage in point” or “price interest point.” It is the smallest unit of price movement in the forex market. For most currency pairs, a pip in forex is typically 0.0001, representing a tiny change in the value of a currency pair.

On the other hand, Lots refer to the size of the trade. In forex, a lot is a standardized quantity of a currency. The most common lot sizes are:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units of the base currency.

- Micro Lot: 1,000 units of the base currency.

The combination of pips and Lots in forex helps traders calculate their potential profits or losses in the market. By knowing how much a pip is worth with the size of their lot, traders can better manage risk and make informed decisions.

Let’s dive into this blog post to clarify both terms better.

Understanding Pips in Forex

A pip, which stands for “percentage in point” or “price interest point,” is a unit of measurement used to describe the slightest price fluctuation caused by any exchange rate.

Currencies are often stated in four decimal places, meaning the slightest change in a currency pair will be in the last digit. This would equate one pip to 1/100th of a percentage or one basis point. For example, if the currency price we quoted changed from 1.1200 to 1.1205, it would represent a five-pip difference.

How are pips calculated?

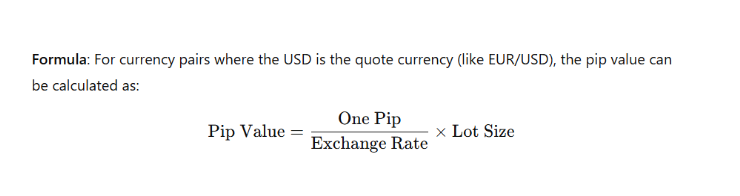

Pips in forex trading are determined according to the price movement of a currency pair. For most currency pairs, the computation is straightforward and involves the fourth decimal point.

A pip equals 0.0001 in most currency pairs (excluding JPY pairs). So, if the EUR/USD moves from 1.1050 to 1.1051, that represents a one-pip move.

For JPY currency pairs, a pip equals 0.01. For example, if the USD/JPY moves from 110.10 to 110.11, that is a 1-pip movement.

Importance of Pips

- Profit and Loss Calculations: Pips in forex help traders determine their profit or loss based on movement. Depending on the lot used, a 10-pip move can result in a different profit amount.

- Risk management: Understanding pips helps a trader know how much one is willing to risk in the trade and set the stop-loss or take-profit levels.

- Consistency: If pips are highlighted, traders can better follow and measure consistent market changes, making more convenient trading decisions.

- Trading Strategy: Pips are at the heart of most forex strategies, as traders usually look to capture small pip movements over time.

Now let’s move on and discuss the other term: Lots in forex.

Understanding Lots in Forex

In forex trading, a lot represents the size of a trade. Since the trading units are large, which involve many currencies being traded, the lots standardize these trade sizes. Instead of purchasing only one currency unit, traders buy in lots representing a specific number of units.

Thus, the lot size in forex determines how much a trader makes or loses per pip movement.

Types of Lots

Forex trading provides a variety of forex lot sizes for traders with differing risk tolerances and account sizes:

- Standard Lot (1,00,000 units)

- It is the most commonly traded Lot.

- Each pip fluctuation represents $10 in profit or loss.

- Ideally suited for professional traders or those with substantial capital.

2. Mini Lot (10,000 units)

- A lower transaction size compared to a regular lot.

- Each pip movement represents $1 in profit or loss.

- Suitable for beginning traders with a modest risk tolerance.

3. Micro Lot (1,000 units)

- The smallest commonly traded Lot.

- Each pip movement represents $0.10 in profit or loss.

- Perfect for beginners and traders with small balances.

How Lot Size Affects Profit and Loss with Pips

Let’s say the EUR/USD moves 10 pips in your favor:

- Trading 1 Standard Lot (100,000 units) → Profit = 10 pips × $10 = $100

- Trading 1 Mini Lot (10,000 units) → Profit = 10 pips × $1 = $10

- Trading 1 Micro Lot (1,000 units) → Profit = 10 pips × $0.10 = $1

The larger the lot size, the higher the profit (or loss) per pip movement.

Thus, understanding forex Lot size charts can help traders to manage their profits and losses effectively.

How Pips and Lots Work Together?

In forex trading, pips and Lots are directly connected in determining a trader’s profit or loss. While pips measure price movement, lot size determines how much money is gained or lost per pip. The larger the lot size, the more significant the impact of each pip movement on a trader’s account balance.

Let’s understand this with the above reference to lot size and its relation with pips:

Let’s say you are trading EUR/USD, and the price moves 10 pips in your favor. Here’s how the profit or loss differs based on the lot size:

- Standard Lot (100,000 units) → 10 pips × $10 per pip = $100 profit

- Mini Lot (10,000 units) → 10 pips × $1 per pip = $10 profit

- Micro Lot (1,000 units) → 10 pips × $0.10 per pip = $1 profit

Similarly, if the market moves against your trade by 10 pips, the loss will be the same amount in negative.

Quick overview of Pips and Lots

|

Features |

Pips |

Lots |

| Meaning | It refers to the smallest price movement in the forex market. | It refers to the standardized quantity of a currency being traded. |

| Standard value | Typically 0.0001 for most currency pairs (except for JPY pairs, where it’s 0.01). | Standard Lot = 100,000 units, Mini Lot = 10,000 units, Micro Lot = 1,000 units. |

| Use case | Help traders measure price movement and determine profits/losses | Determines the size of a trade and the exposure to market fluctuations. |

| Impact on profit/loss | A change of one pip can result in profit or loss depending on the trade size. | The larger the lot size, the greater the potential profit or loss from a single pip movement. |

| Example | If EUR/USD moves from 1.1050 to 1.1051, that’s a 1 pip movement. | If you buy 1 standard lot of EUR/USD, you’re trading 100,000 units of the euro. |

| Relevance | Important for calculating price movements in trading. | Critical for managing risk and determining the amount of capital needed for a trade. |

| Calculation | Pips are counted based on the 4th decimal place for most pairs. | Lot size determines how much a pip is worth in terms of money (e.g., $10 per pip for a standard lot). |

Thus, this table gives you a complete overview of both pips and Lots in forex.

Key takeaway

Now that you have understood the importance of both terms in forex trading, once you start applying this knowledge on pips and Lots in your next trade, you can do so much more in your trading journey.

Open a demo account today and start trading now!