UK CPI Expected to Accelerate in October, Reducing Odds of Further BoE Rate Cuts

The Office for National Statistics (ONS) will release the United Kingdom’s Consumer Price Index (CPI) data for October on Wednesday at 07:00 GMT. This inflation report is pivotal for determining the Bank of England’s (BoE) future interest rate policy and could significantly impact the Pound Sterling’s trajectory.

Key Expectations for UK CPI Data

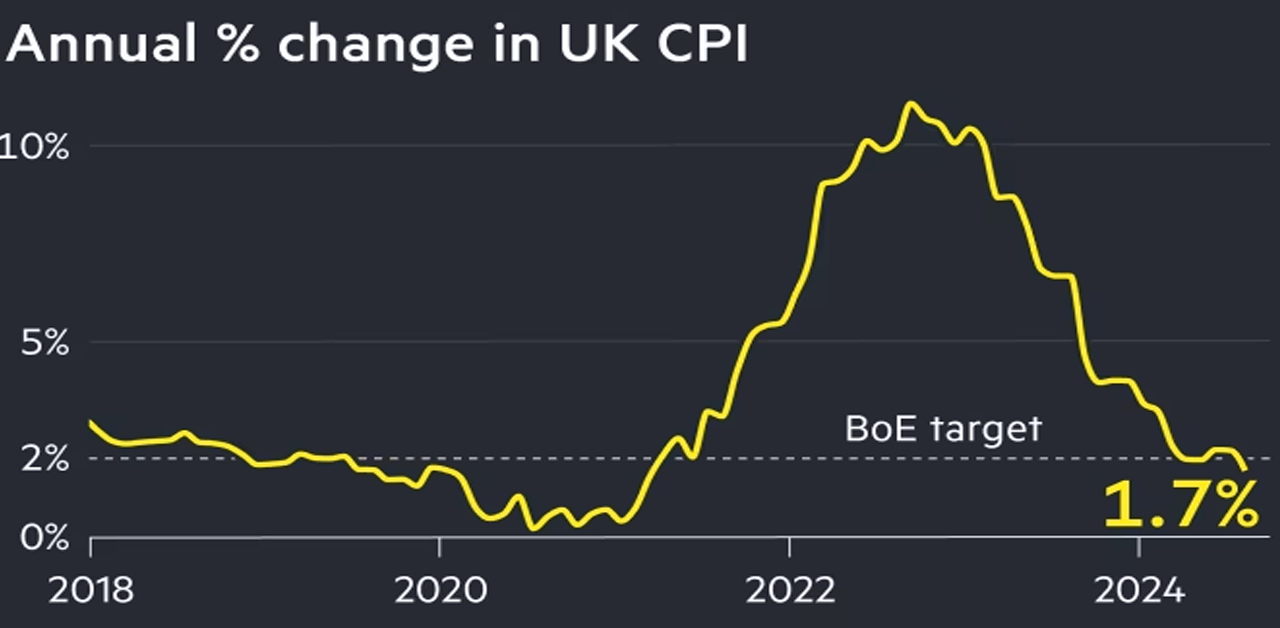

- Annual Headline CPI: Expected to rise to 2.2% in October from 1.7% in September, moving back above the BoE’s 2.0% target.

- Core CPI Inflation: Forecasted to ease slightly to 3.1% YoY from 3.2% in September.

- Services Inflation: Anticipated to edge lower to 4.8% YoY from 4.9%, aligning closely with the BoE’s 5.0% projection.

- Monthly CPI: Projected to increase by 0.5% after a flat 0% reading in September.

Societe Generale analysts attribute the expected headline CPI rise to base effects and higher utility prices, noting that services inflation could climb slightly to 5% YoY, though downside risks remain.

Impact on BoE Policy and GBP/USD

Following its November 7 decision to cut interest rates by 25 basis points to 4.75%, the BoE emphasized a cautious approach to future rate adjustments, maintaining a restrictive stance to ensure inflation returns sustainably to its 2.0% target.

- Higher-than-Expected CPI: Would likely reduce market expectations of further rate cuts and could provide a boost to the Pound Sterling. GBP/USD may see a recovery from recent six-week lows, with the pair testing resistance levels.

- Lower-than-Expected CPI: Could reinforce the case for continued BoE easing, weighing heavily on GBP/USD and potentially pushing the pair toward the 1.2500 psychological level.

BoE Governor Andrew Bailey recently highlighted inflationary pressures from the Labour government’s tax policies, reinforcing the central bank’s cautious approach to monetary easing.

Technical Outlook for GBP/USD

Key Levels to Watch:

- Upside: Immediate resistance lies at the 1.2750 level, followed by the 200-day SMA at 1.2820 and the 21-day SMA at 1.2858.

- Downside: Immediate support is seen at multi-month lows of 1.2597, with further downside potential toward the 1.2500 round level.

RSI and Moving Averages:

The 14-day Relative Strength Index (RSI) remains below 50, signaling persistent downside risks. Additionally, the 21-day SMA is poised to cross below the 200-day SMA, forming a bearish “Death Cross” pattern, which could amplify selling pressure.

Conclusion

The UK CPI report will play a critical role in shaping market expectations for the BoE’s monetary policy trajectory. A stronger inflation print may support a GBP/USD recovery, while weaker-than-expected data could deepen losses. Traders should also watch for additional cues from the UK Finance Minister’s Autumn Budget and BoE commentary to gauge the broader economic outlook.