Japan’s Core Machinery Orders Drop in April, Sparking Capital Spending Worries

Japan’s core machinery orders experienced a decline in April for the first time in three months, according to data released by the Cabinet Office on Monday. This development raises concerns about the robustness of capital spending, a critical component for a sustainable economic recovery. The decline follows the Bank of Japan’s (BOJ) recent decision to begin reducing its extensive bond purchases, with a detailed plan expected to be announced next month on managing its nearly $5 trillion balance sheet.

In April, core machinery orders fell by 2.9% month-on-month, slightly better than the 3.1% decline anticipated by economists in a Reuters poll. This drop marks the first decrease in three months for this highly volatile data series, which is often used as a leading indicator of capital spending in the next six to nine months. Despite the decline, the Cabinet Office maintained its assessment that machinery orders are showing signs of picking up.

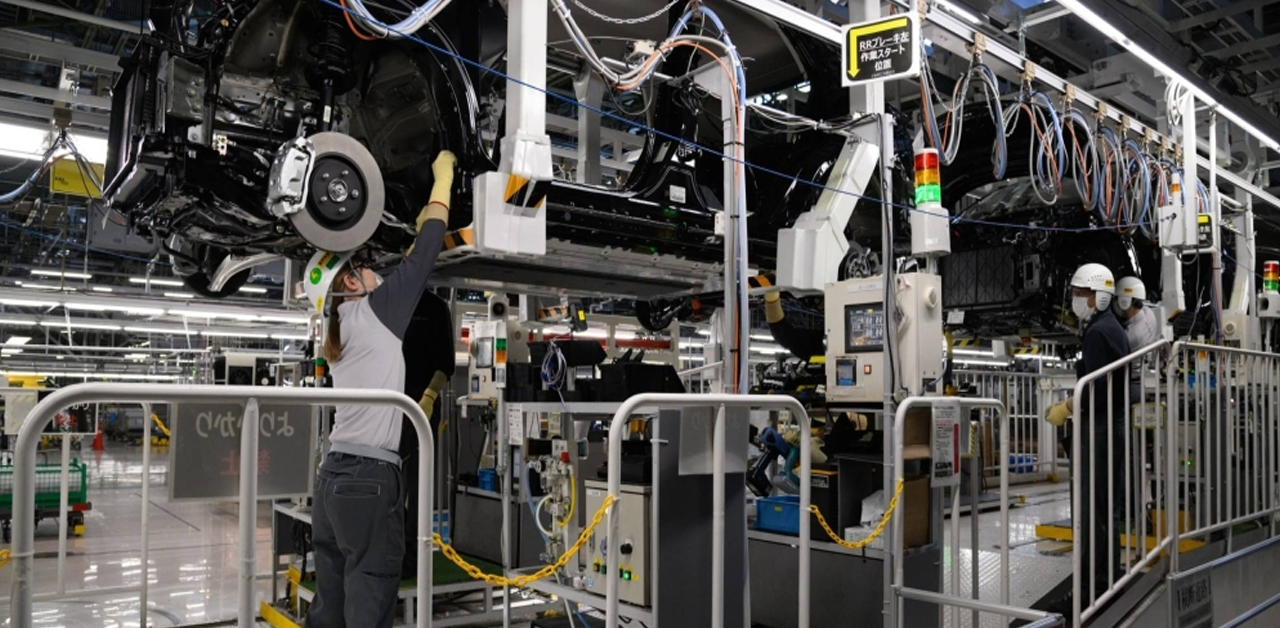

Japanese companies typically draft substantial spending plans to enhance their factories and equipment but often delay execution due to economic uncertainties. The ongoing weakening of the yen has not significantly boosted domestic capital investment, as Japanese firms prefer to invest directly overseas where demand is stronger. This trend has further complicated the domestic capital spending outlook.

Breaking down the data by sector, core orders from manufacturers plummeted by 11.3% month-on-month in April, a stark contrast to the 19.4% increase observed in March. On the other hand, core orders from non-manufacturers rose by 5.9% in April, recovering from an 11.3% decline in the previous month. This mixed performance across sectors highlights the uneven nature of the recovery in capital spending.

On a year-on-year basis, core machinery orders increased by a modest 0.7% in April. This slight annual gain underscores the challenges faced by the Japanese economy as it navigates through a complex landscape of domestic and international economic factors. The upcoming detailed plan from the BOJ on reducing its bond holdings will be closely watched for its potential impact on capital spending and overall economic recovery.

As Japan continues to grapple with these economic challenges, the latest machinery orders data serves as a reminder of the fragile nature of its capital spending and the need for continued vigilance in economic policy and investment strategies.