Japanese Yen Weakens Amid Fading Hopes for BoJ Rate Hikes, FOMC Minutes in Focus

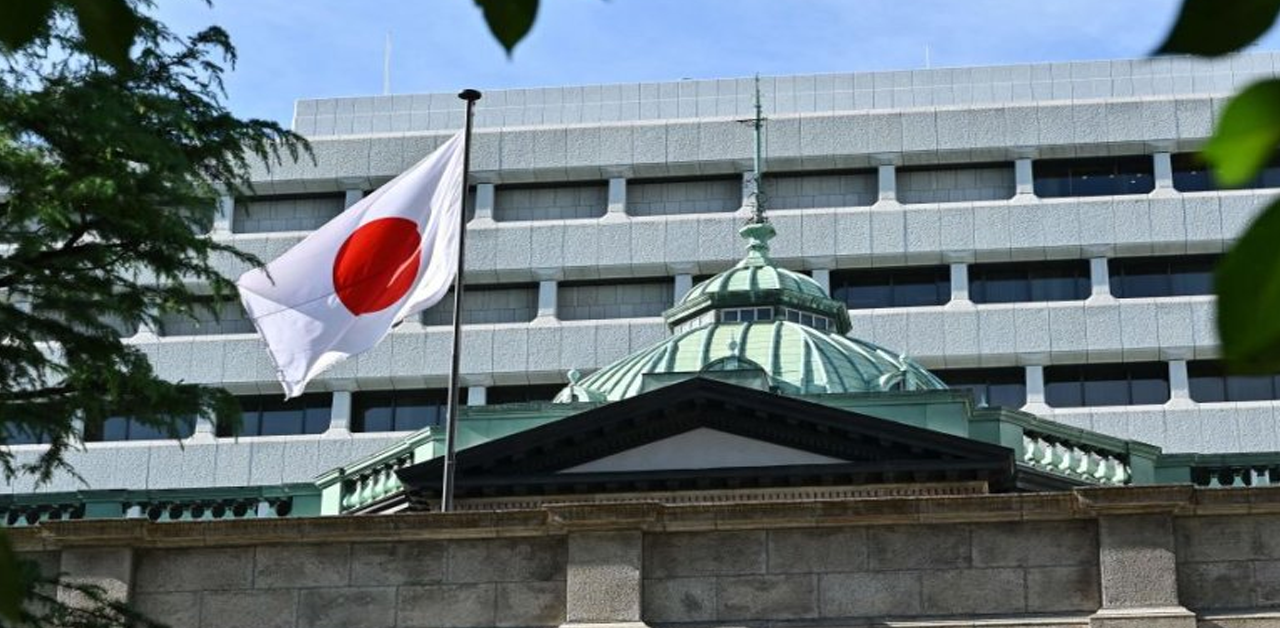

The Japanese Yen (JPY) continued to drift lower against the US Dollar (USD) on Wednesday, approaching levels last seen in mid-August. Recent economic data from Japan revealed that real wages declined in August after two consecutive months of gains, while household spending also dropped. This raises concerns over the strength of private consumption and the sustainability of Japan’s economic recovery. Additionally, comments on monetary policy from Japan’s new Prime Minister have added to the uncertainty surrounding the Bank of Japan’s (BoJ) potential for future rate hikes, further weighing on the JPY.

Adding to the Yen’s weakness, reports of a possible ceasefire between Hezbollah and Israel have reduced demand for the safe-haven currency. Meanwhile, the US Dollar has gained strength, nearing its seven-week high, as markets reduce expectations for aggressive policy easing by the Federal Reserve (Fed). This has pushed the USD/JPY pair beyond the mid-148.00s during the European session.

Despite the current upward momentum for the USD/JPY pair, market participants remain cautious, as Japanese authorities may intervene to support the Yen. Additionally, the release of the Federal Open Market Committee (FOMC) meeting minutes later on Wednesday could influence the pair’s direction, depending on how the outlook for US monetary policy unfolds.