BOJ May Consider Reducing Bond Purchases as Rate Hike Approaches

The Bank of Japan (BOJ) is anticipated to discuss reducing its bond purchases at a policy meeting concluding on Friday, with expectations also set for preparations to increase interest rates as early as next month.

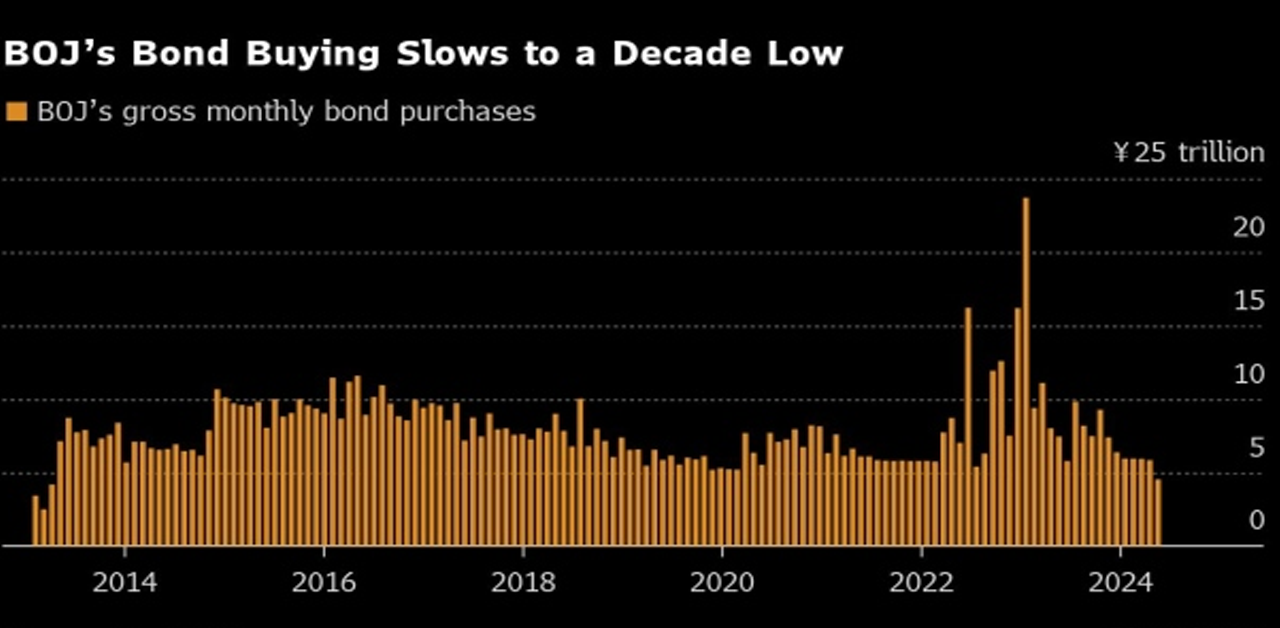

All but one economist in a Bloomberg survey expect the BOJ to maintain its policy rate between 0 and 0.1% after the two-day meeting. However, a majority foresee a decision to decrease monthly bond purchases from approximately ¥6 trillion ($38.6 billion). Discussions earlier in the month suggested that the BOJ might consider the timing suitable for slowing down bond buying.

Such a move would signify the BOJ’s initial firm steps towards quantitative tightening, having shifted from its extensive stimulus strategy in March. Although the BOJ states it does not aim to control foreign exchange rates, a reduction in bond purchases or a definite move towards more restrictive policy could help alleviate the ongoing depreciation of the yen.

Amid these expectations, upcoming U.S. data is projected to reveal a slowdown in inflation for May. The Federal Reserve is also expected to maintain its current interest rates, with focus on any new signals from Chair Jerome Powell regarding future rate cuts.

The challenges for BOJ Governor Kazuo Ueda are mounting, as he seeks to balance bond purchase reductions without causing undue market disruption. In his previous press conference in April, Ueda’s nonchalant remarks on the yen’s strength led to the currency hitting a 34-year low, resulting in significant intervention by the finance ministry.

The BOJ has been closely monitored for its bond buying strategy, especially after a market shake-up on May 13 when it reduced its purchases, followed by a lack of sellers in a subsequent operation—a first since 2013. With bond redemptions expected to reach ¥71.4 trillion this year, a monthly purchase rate below ¥5.95 trillion would imply a decline in the BOJ’s bond holdings, aligning with quantitative tightening.

Economists are split on how the BOJ will approach the reduction of its bond buying, with some predicting a slowdown of ¥1 trillion per month, while others anticipate a more cautious initial reduction. Many expect the BOJ to soon outline a formal plan for decreasing its bond purchases.

With the yen remaining weak, there is growing speculation that the BOJ might raise its policy rate in July, marking its second rate hike in 17 years. Observers are keenly awaiting any indications from Ueda at this week’s meeting, with one-third of surveyed economists predicting a rate hike in July, up from 19% in April. Ueda is expected to strike a careful balance in his statements to avoid triggering a spike in yields alongside the planned bond purchase reduction.