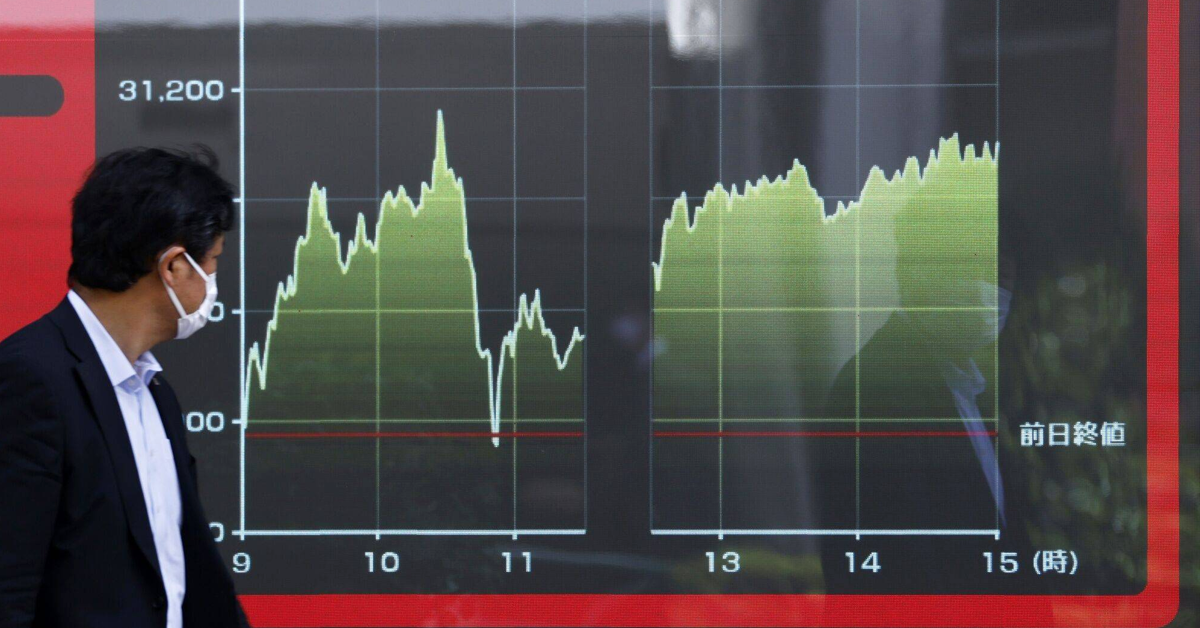

Nikkei 225 & Hang Seng Fall: Rising US Yields, Lower Risk Appetite

Asian stocks witnessed a pronounced downturn on Friday, largely influenced by global bond market dynamics that have steadily been weakening investors’ risk appetite. The situation is further exacerbated by mounting concerns over the escalating tensions between Israel and Hamas. This geopolitical instability, coupled with economic concerns, has made investors increasingly wary.

The possibility of the United States raising its interest rates has cast a shadow over the regional markets. Higher interest rates typically deter risk-oriented investments, making these markets less attractive. Such a move by the U.S. can potentially limit the inflow of foreign capital, thereby stifling the economic potential of these regions.

Delving into specific market metrics, as of the latest update, the SSE Composite Index in China recorded a 0.27% drop, settling at 2,997 points. Meanwhile, the Shenzhen Component Index saw a dip of 0.36%, bringing it down to 9,620 points. Japan’s flagship index, the Nikkei 225, also wasn’t spared, falling 0.18% to 31,375. The Hang Seng in Hong Kong reported a 0.41% decrease, the Korean KOSPI index slid to 2,382, and Taiwan’s Weighted Index declined by 0.20%.

In China, concerns surrounding its property sector played a significant role in the stock market’s dip. Despite data suggesting robust economic growth, these concerns have acted as a counterbalance, diluting the market’s potential growth. Adding to the Chinese market’s woes is the looming uncertainty about a potential default by real estate giant, Country Garden Holdings. The company’s recent failure to make a timely payment on its international bonds has left traders and investors on edge, making them more cautious about Chinese assets.

Japan’s equity market took a hit when data released on Friday showed that the consumer price index inflation in September surpassed prior expectations. It’s worth noting that this inflationary indicator, which the Bank of Japan (BoJ) monitors closely, is at a level reminiscent of figures seen over four decades ago. Such statistics underline the enduring nature of inflationary pressures within Japan’s economic framework.

Moreover, the tech sector in Asia, which often serves as a barometer for global tech trends, has been under considerable strain this week. This is primarily due to a surge in global bond yields, causing investors to reconsider their stance on growth stocks. As a result, the appeal of tech shares in the region has waned. Significant players like SK Hynix Inc and Samsung Electronics saw their stock prices decline, adding to the downward pressure on South Korea’s KOSPI index.

.webp)