What is Slippage and How to Avoid Slippage While Trading?

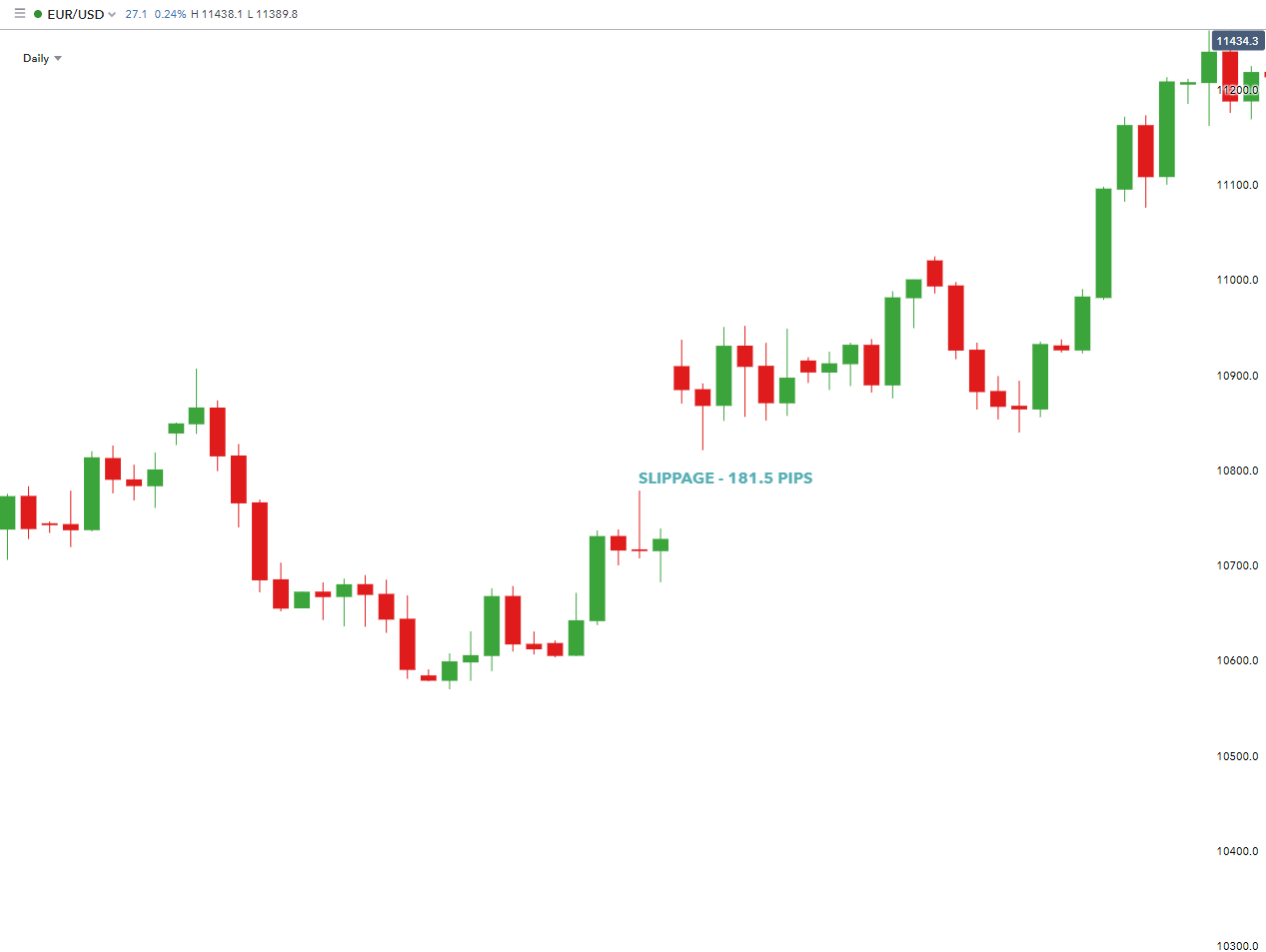

Slippage is defined as the term that refers to describe the difference between the expected price and the actual price in which the trade price is executed.

The Slippage is the phenomenon that occurs in the market orders while placing an order during the periods of the market volatility when large market orders are placed at a time when there is some insufficient buying Interest to maintain the expected to the trade price. Slippage is occurred due to the fast pace of the price movements in the financial market the delay exists between the point placing an order when the time is completed.

Why Slippage Is Occur?

When you start trading & the slippage occurs, if the trade order is executed without a corresponding limit order if you want to stop loss than you will need to place that at the favorable rate to the original price. In the Forex trading, the trades will execute at the next price unless there is a limit order to stop the trade in some of the particular price.

How To Minimizing the Slippage In Forex Trading?

Slippage is exceptionally normal during times of high instability when costs move quicker than anticipated. While a little unpredictability is useful for quick Forex Brokers, a lot of it can prompt huge misfortunes, particularly in exceptionally used trades.

Try to Avoid Markets Orders

You will need to avoid the Market orders, Instead of this, you can use the limit order it will help you to manage the slippage. Moreover, under the limit order, you will need to get the executed at the worst price. Here you will need to remember that using limit orders may mean passing up some worthwhile positions.

A market request will guarantee your ways out however will consistently involve risk of slippage. In some quick-moving economic situations, market orders are important. By and by, attempt to get into breaking point and stop-limit orders at whatever point conceivable.

Always Use Stop Losses

One of the most important task to manage the slippage is you will need to use the risk management tools like Stop loss that cuts the short trades when the market move to the unfavorable direction. In Case you are using the stop loss limit order the limit order will be filled at the price that you want to place.

Avoid to Place Trade On Major Events

Market moving news occasions increment the risk of negative slippage, which is the reason informal investors ought to abstain from trading the quick effects of such news releases. These incorporate declarations, organization general body functions, the arrival of benefit and loss explanations, the arrival of financial pointers like increasing and loan costs, and then some. An economic calendar is basic to monitor the dates of these performances. This permits brokers to know which resource class is probably going to show instability.

Avoid Low Liquidity Asset

High liquidity implies a shortage of buyers and seller to finish your requests. This expands the danger of negative slippage. The forex market is known for its incredibly high liquidity, while some digital currencies are inadequately changed. Additionally, only one out of every odd money pair is as fluid, with slippage being more normal for fascinating cash sets.

It is helpful to monitor the busiest times of the market. For instance, the forex market is profoundly fluid when the London and New York meetings cover. This is the most dynamic time frame for GBP, USD, and EUR traders. It will be simpler to reduce slippage during such occasions.

Avoid Using Robust Trading Platform

Choosing a good trading platform is a significant piece of decreasing organization unemployment and guaranteeing that trades get performed at high speeds. Settling on this viewpoint could be expensive for a broker. There are powerful stages like MT4, MT5 which make life simpler through order types and prevalent to chart abilities.

There can be numerous concealed issues also, for example, wasteful request directing, information slack, and worker execution, which can affect trades. Your representative should be prepared to deal with every specialized issue and offer fast arrangements in Forex Products. At that point, there are a few issues that are not under a merchant’s control, which is the reason backing of a rumored business is fundamental.

.webp)

Recent Articles

What is a Forex Trading Robot or Forex Expert Advisor?

What is the Fastest Way to Learn Forex?

How to Determine Trends on Forex Market

8 Reasons You Should Learn To Read Price Action

Top Currency Pairs to Trade for Beginners