New Zealand’s Current Account Deficit Beats Economists’ Expectations

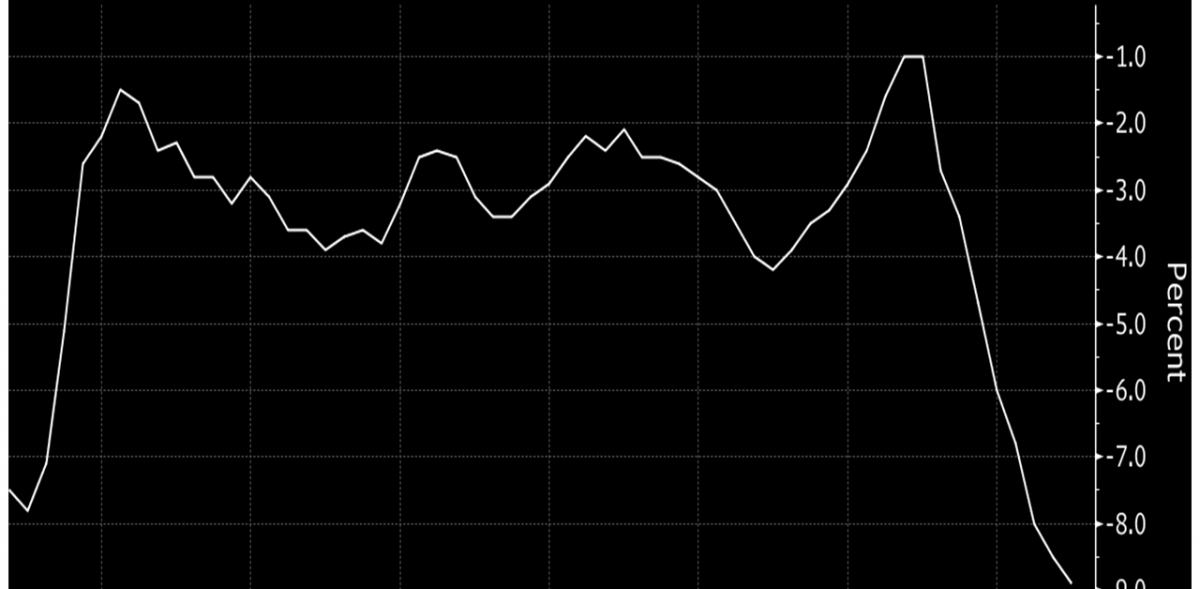

New Zealand’s current account deficit has decreased by $1 billion during the June quarter, dropping to $6.7 billion from $7.7 billion in the previous three months, as reported by Statistics NZ. This deficit signifies that New Zealand is spending more than it is earning overseas. Before the pandemic, the deficit ranged between 1% and 4% of GDP, but it surged to over 8% in late 2022 due to the pandemic’s disruption, poor agricultural production, and higher global interest rates.

However, there has been a turnaround in recent quarters, with the deficit shrinking. At the end of June 2023, the annual current account deficit stood at $29.8 billion, equivalent to 7.5% of GDP. This is an improvement compared to the previous year-end figure of 8.8%, or $33.8 billion, and it exceeded economists’ forecast of just below 8%.

Economists, such as Miles Workman from ANZ Bank, appreciate the narrower current account deficit but warn that the accounts are still “severely out of balance.” They caution that New Zealand remains vulnerable to external shocks and prolonged unsustainable deficits caused by a potential terms of trade shock or drought. The deficit, despite the improvement, is still at levels unseen since 2008.

The increase in the annual trade deficit by $1.2 billion in the year ending June 2023 is mainly attributed to the rise in imports, particularly fuel. Fuel prices and volume contributed to the growth in goods imports. On the other hand, goods exports increased by $5.5 billion, driven primarily by dairy products.

In terms of services, export growth outpaced imports, with a $9.8 billion increase in service export and a $7.4 billion increase in service imports. Spending by overseas visitors in New Zealand increased significantly, while the amount spent by New Zealanders overseas grew at a slower pace. This resulted in a wider primary income deficit, indicating that overseas investors were earning more from New Zealand than the other way around.

The increase in interest rates played a role in larger interest payments to foreign investors and contributed to the widening primary income deficit. Additionally, foreign investors increased their holdings of New Zealand issued bonds in the year ending June 2023.

Although the recovery in international tourism and education is progressing well, potential consumers may face economic difficulties that could discourage them from traveling to or using services in New Zealand. ANZ’s Miles Workman suggests that lifting exports beyond pre-COVID levels may be challenging in the current slowing global economy. Factors such as bad weather, regulatory changes, labor constraints, and shipping disruptions have affected goods exports. Export prices have also been falling relative to import prices, indicating potential challenges ahead. As a result, New Zealand may rely on cooling domestic demand to restore balance in the short term.

.webp)