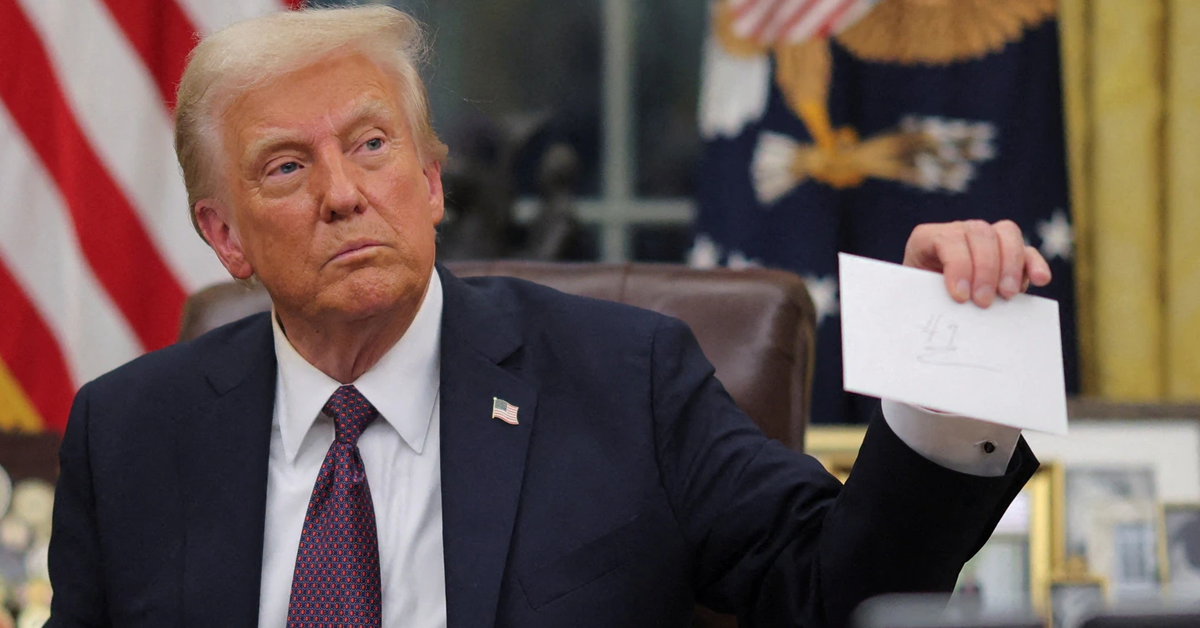

West Texas Intermediate (WTI), the benchmark for US crude oil, is trading near $75.55 on Wednesday, retreating as US President Donald Trump announces plans to expand domestic oil and gas production and impose tariffs on key trading partners.

On Monday, Trump declared a national energy emergency, granting authority to fast-track approvals for oil, gas, and electricity projects that would typically face years of regulatory hurdles. This move has sparked concerns about increased US output in a market already projected to face oversupply in the coming year.

Trump also hinted at imposing a 25% tariff on imports from Canada and Mexico, along with a 10% tariff on goods from China, starting February 1. Such measures could dampen economic growth, further pressuring oil demand and contributing to the weakness in crude prices.

Meanwhile, the US Energy Information Administration (EIA) noted on Tuesday that oil prices are likely to decline this year and next due to sluggish economic activity and ongoing energy transition efforts. “Strong global growth in the production of petroleum and other liquids, coupled with slower demand growth, is expected to exert downward pressure on prices,” the EIA stated.